NAWEC Undermined by Government's D248 Million Arrears in Unpaid Bills

Minister for Petroleum, Energy, and Mines Hon Nani Juwara © State House of The Gambia

By Edward Francis Dalliah

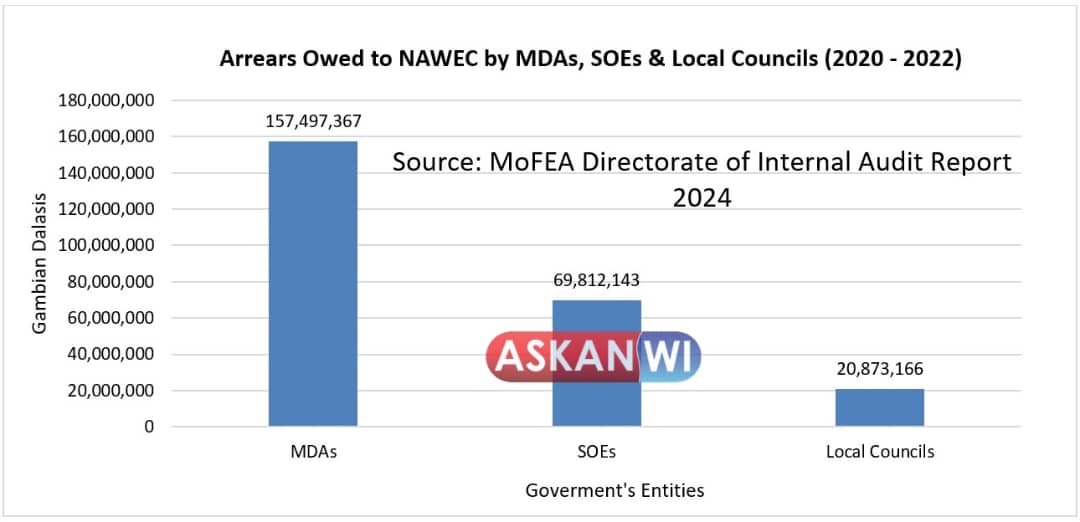

The National Water and Electricity Company (NAWEC) is grappling with significant financial challenges due to unpaid bills from government ministries, departments, and state-owned enterprises (SOEs). This growing debt, highlighted in the 2024 Final Report of the Directorate of Internal Audit on SOE arrears for 2020-2022, underscores the severe financial pressures facing the country’s main utility provider.

As of 31st December 2022, the government owed NAWEC a staggering D248 million for unpaid electricity and water bills. The Ministry of Health tops the list, with an outstanding balance of D66 million, followed by the Gamtel at D46 million and the Ministry of Defence at about D19 million. Surprisingly, the well-funded Office of the President comes fourth in the list of institutions owing NAWEC with almost D17 million in debt.

Government’s Failure to Pay NAWEC’s Bills Despite Budget Allocations

Even though government institutions are typically allocated funds to pay these bills, the Directorate of Internal Audit report reveals that the government has repeatedly failed to settle its electricity and water bills. This suggests that allocated funds are either redirected to other expenses, insufficiently disbursed for bill payments, or possibly misused through corrupt practices.

In addition to central government institutions, local councils, responsible for streetlights, also owe NAWEC millions, further increasing the company’s financial burden. These unpaid bills have contributed to the financial struggles of the state-owned enterprise, hindering its ability to deliver services to customers who pay for electricity and water.

NAWEC Implements Tariff Increases

To address their financial strain, NAWEC announced a tariff increase in March 2023, aiming to close the gap between revenue and expenditure. In a press release, the company stated, “In October 2022, NAWEC applied for a tariff revision for both water and electricity services. The Utilities Regulator (PURA) approved the increase following a thorough review and consultation process.”

NAWEC justified the increase, claiming it was necessary to cover rising production, maintenance, and upgrade costs, ensuring continued service delivery. As a result, the tariff for electricity was raised by 37%, and water tariffs by 20%. This means that when customers buy D1,000 cash power, they will receive fewer units compared to before the tariff increment.

The new tariffs for electricity charges are as follows:

Domestic consumers (households): D13.85 per kilowatt, up from D10.14

Commercial customers: D14.90 per kilowatt, up from D10.90

Hotel industries: D15.90 per kilowatt, up from D11.65

Agricultural customers: D13.89 per kilowatt, up from D10.14

Area councils: D16.20 per kilowatt, up from D10.90

Central government: D16.20 per kilowatt, up from D10.90

Despite these increases, NAWEC continues to face financial difficulties, even with prepaid electricity purchases.

NAWEC’s Ongoing Financial Struggles

Though the tariff hikes were intended to address the financial gap, NAWEC continues to suffer significant losses. The SOE Commission’s Biannual Financial Report for 2024 revealed that, despite generating the highest revenue among SOEs from January to June 2024, NAWEC posted a net loss. According to the report, “NAWEC generated a total revenue of D4.12 billion for the same period but incurred an operating net loss of D20.7 million. Due to substantial losses from foreign exchange transactions, the company registered a loss of D1 billion.”

The report further indicates that NAWEC struggles with cost recovery, meaning it doesn’t generate enough revenue to cover its operational costs. It also faces liquidity issues, making it difficult to meet short-term liabilities, and a high debtor turnover ratio, suggesting challenges in collecting payments, particularly from state institutions.

With these issues, NAWEC is in a precarious financial position, posing a significant fiscal risk to The Gambia’s economy. The report notes that the company is “facing severe financial constraints” and recommends “emergency intervention due to the fiscal risks it poses to the Gambian economy.” The SOE Commission further suggests that NAWEC requires “the development and implementation of a turnaround strategy to address its financial, governance, and operational challenges.”

NAWEC’s Growing Debt

With many customers failing to pay their bills, NAWEC is forced to accumulate debt to Senelec and Karpower, the suppliers it relies on for power generation. During his December 2024 appearance at the National Assembly, Minister for Petroleum, Energy, and Mines Hon. Nanni Juwara was asked by Banjul North National Assembly Member Hon. Modou Lamin Bah to explain the size of the Gambia's debt to these companies and the reason for the growing arrears despite prepaid electricity purchases.

In response, Minister Juwara stated, “As of 30th September 2024, the outstanding invoices for Karpower and Senelec are as follows: Karpower owes $8.4 million for invoices from June, July, and August 2024, [and] Senelec owes 9.8 billion CFA, approximately $16.1 million, for invoices from June to September.”

The minister attributed the delay in payments to “cash flow challenges faced by NAWEC due to the cost-reflective tariff, compounded by the rising cost of foreign currency as both Karpower and Senelec require payments in foreign currencies, which continue to appreciate against the dalasi.” He added that the fluctuating currency rate has increased the debt burden by about D796 million.

Domestic Debt Issues

The 2024 Final Report from the Directorate of Internal Audit on SOE arrears reveals that NAWEC has also accumulated significant domestic debt. The company has received loans for various projects, with a total outstanding loan balance of D430.3 million as of the review period.

As both a creditor and a debtor, NAWEC’s ability to operate efficiently is severely hindered. The company struggles to maintain infrastructure, invest in power generation, and meet its financial obligations. These financial constraints have led to frequent power outages, water shortages, and delays in network upgrades, affecting businesses, hospitals, and households across the country. Without urgent action, the situation may worsen, further disrupting essential services nationwide.