Is Semlex Paying all its taxes?

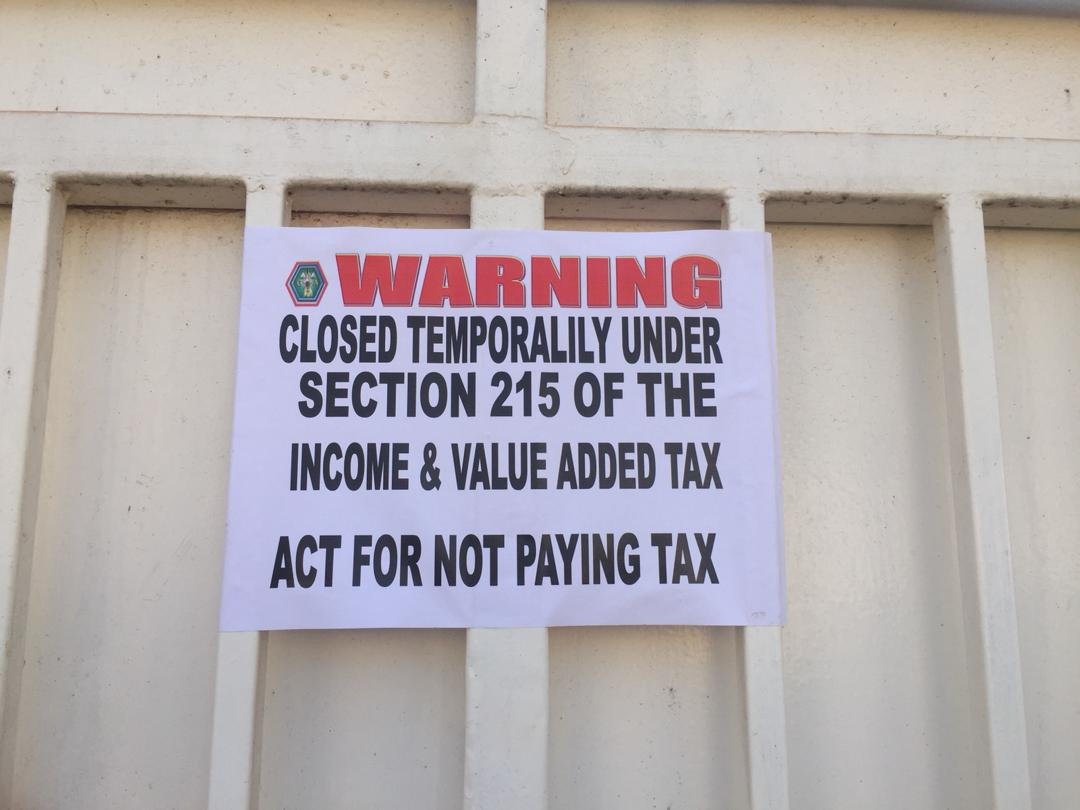

Notice from GRA on SEMLEX Closure © Askanwi

By Yusef Taylor, @FlexDan_YT

Last month a Brussels based company named Semlex, contracted to produce National Documents for The Gambian Government was shut down “temporarily under section 215 of the Income and Value added Tax Act for not paying tax”. The next day news that the company had paid over D300,00 Dalasis left a number of people scratching their heads, wondering how Semlex could only pay D300,000 in taxes. One newspaper reported that the actual sum paid by Semlex was D390,000. Non the less it was a relatively low when compared to taxes paid by Banjul Breweries.

Last year Gainako reported an article in which Banjul Breweries claimed to have paid D115 Million in taxes from Jan to April 2019. Excise taxes on Beer had increased from 10% to 75% forcing the country’s on Alcoholic Breweries to pay hundreds of millions in taxes within a 4-month period.

How Many ID Cards will D390,000 Print?

One common sense check is to check how many National ID cards can be made from D390,000. If one ID Card costs D850 then D390,000 will print 459 ID Cards. If this amount represents 15% of all revenues made by Semlex then 100% of all revenues raised will amount to D2.6 Million Dalasis and print around 3,060 ID Cards. Considering that Semlex print both Drivers License and ID Cards it seems highly unlikely that they would print less than 4,000 cards in one calendar year.

2018 Revenues Generated from National Documents

Another way to assess the amount of taxes paid by Semlex is to assess the total amount of revenues generated by the government in one calendar year from production of National Documents. Observing the 2020 Estimate of Revenue and Expenditure details actual revenues generated from Official Documents in 2018. See image below.

The table below compiles all the various revenue streams arising from National Documents totalling more than 52.6 Million Dalasis. If Semlex paid 15% of taxes in 2018 they would have paid over D7.9 Million Dalasis in taxes. On the other hand the D390,000 Semlex paid in February 2020 represents less than one percent (0.7%) of D52.6 Million.

Tax Exemptions and Revenue Sharing

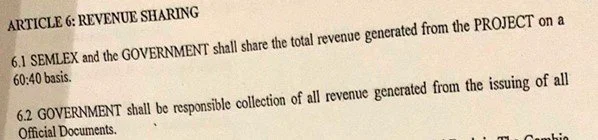

Semlex first signed a contract with The Government back in 2016, a new contract subsequently signed in 2018. According to a contract dated May 2018, published by Right To Know - R2K between Semlex and The Gambia Government, The Gambia shall share revenue generated from the Project on a 60:40 basis. The contract also states that the Government shall be responsible collection of all revenue generated from the issuing of all Official Documents.”

One of the most controversial issues in the contract is the specific mentions of various tax exemptions that the Government has agreed with Semlex. If this is the most recent contract then it needs to clearly explained what taxes that Semlex are due to pay.