Will Parliamentarians Debate 23% Increase in Taxes for 2025?

Members of the Sixth Legislature © Askanwi Media

By Yusef Taylor, FlexDan_YT

In all my years of covering Parliament’s Budget process from 2015 to date, I have never seen Parliamentarians debate the government’s revenue measures during the Budget Session. Every year the government usually increases its revenue plans (including taxes) but Parliamentarians appear to be failing to debate this important issue which has a major impact on cost of living in the country.

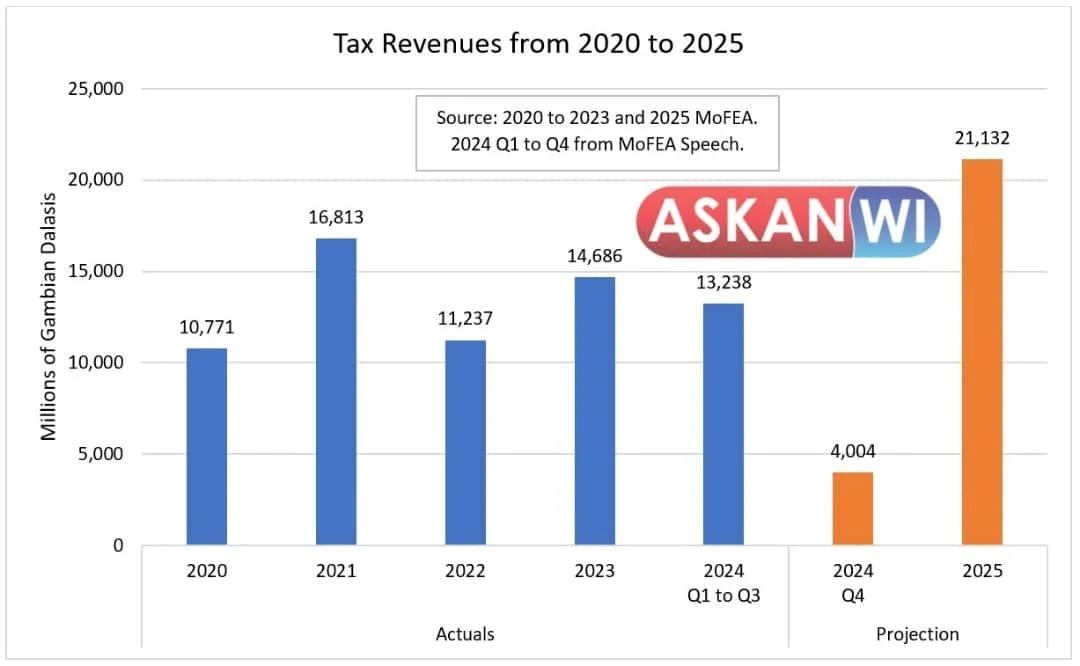

To underscore the importance of this Finance Minister, Hon Seedy S Keita revealed that “tax revenue is expected to increase by 23%” in 2025 when tabling the 2025 Budget on 15th November 2024. But to date, the government’s plans to increase tax revenue remains unknown.

If tradition continues the revenue measures for 2025 will not be submitted for Parliamentary Review, unless, Parliamentarians demand it from the Finance Ministry. Unfortunately, what usually happens is that the Executive’s revenue measures are only seen at the Budget Speech, by which time there is no allocated time for debates on the budget. At that point Parliamentarians just proceed to approve the Budget and the Government’s revenue measures without any substantial debate or review.

But what does the law say about Taxation in The Gambia?

According to provision 149 of the 1997 Constitution which is on Taxation;

(1) No taxation shall be imposed except by or under the authority of an Act of the National assembly

(2) An Act of the National Assembly may make provision –

a. for the collection of taxes proposed to be imposed or altered in a Bill which has been presented to the National Assembly during a period of four months from the date of presentation or such longer period as may be specified in a resolution passed by the National Assembly after the Bill has been presented; or

b. for any local government authority established by law to impose taxation within the area for which such authority is established, and to alter such taxation, but no provision shall include the power to waive any tax due.

(3) Where any law confers power on any person or authority to waive or vary a tax imposed by any law, the exercise of that power in favour of any person or authority shall be subject to the approval of the National Assembly.

The point I am trying to make was emphasised by the GRA Commissioner General Yankuba Darboe in early 2024 during a press conference when he said: “only the Ministry of Finance can introduce [taxes] and that has to go through Parliament. And the Budget Speech has been read already but GRA we are an operational institution, the Policy arm of the government is the Ministry of Finance. And even at the level of the Ministry of Finance they can also introduce it to Parliament. The Parliamentarians can reject it if they don’t want the tax”.

Increase in taxes in 2024 © Askanwi Media

Last year the Government increased taxes as detailed in the 2024 Budget Speech. The Finance Minister’s latest speech gives an idea how much tax revenues has been collected this year. If this aggressive approach continues in 2025 this will have a negative impact on cost of commodities, resulting in hyper-inflation. The chart below depicts how Actual Taxes and Projections for the rest of the year and 2025 compares.

From the Finance Minister’s speech, it appears both the Executive and Parliament are in favour of a salary review but if salary reviews are compounded with tax increases, commodity prices may surpass the salary increases and this could lead to inflation which will pose a challenge for low-income earners in particular.

The only saving grace is a Parliament that is bold enough to wield its power to demand the government presents its revenue measures for 2025 and debate it accordingly. If Gambian Parliamentarians continue focusing on salaries and other personnel emoluments instead of the government’s revenue measures, then Gambians can expect a more difficult 2025 even after a 30% salary increase.

Digitized by Yusef Taylor for Askanwi Media

Yusef Taylor is an experienced Parliamentary reporter.